Housing Industry Report : Inflation Is Your Friend?

Inflation is a scary word to many people. The economic definition of inflation is ”a general increase in prices and fall in the purchasing value of money”. The Webster's dictionary definition would cause anyone to pause and wonder how it affects them personally. However, sometimes when you only choose to look on the surface of something you don’t realize that there are other, more positive, outlooks and interpretations that remain unspoken that counter such a frightful reaction.

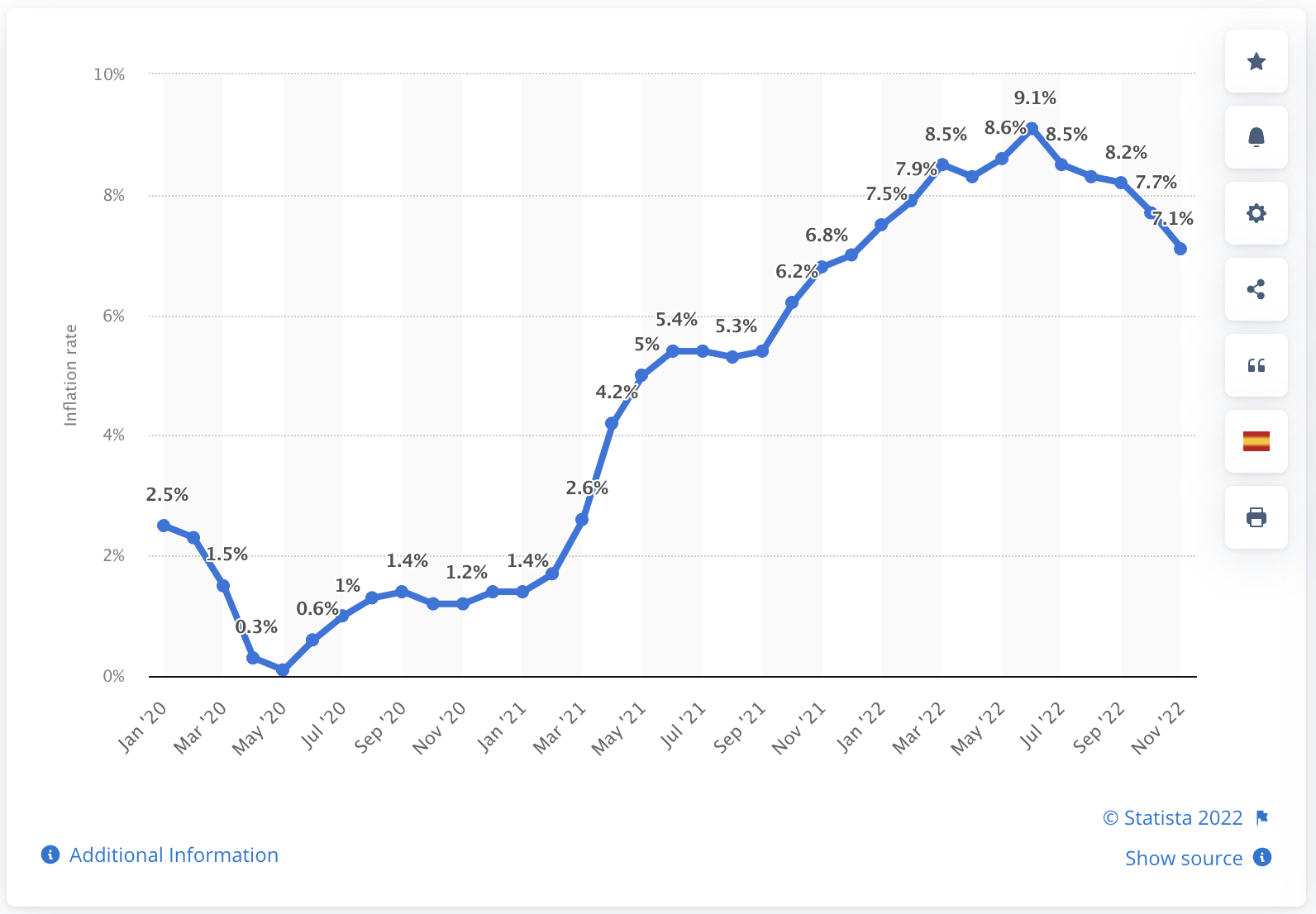

The chart below, courtesy of Statista, showcases how inflation affected the US economy from the beginning of the pandemic, January 2020 through to November 2022. As you can see, what the media doesn’t highlight is that the inflation rate is on a down trend, with the prediction of it leveling back out in the coming year or two.

Historically, the US average inflation rate, which most people know as the cost of living increase, is 3%, 3.8% to be exact. According to World Data, tracking inflation over the past 61 years and comparing the Americas to Europe, in 1980 the inflation rate in the US was 13.55%! The following year in 1981 the inflation rate was 10.33%. These historical rates were much higher than what we are seeing today. Conversely, there have also been years where inflation was negative. They are very rare but it does happen. In 2009, the inflation rate was -0.39%. The moral of this story is that everything is relative to time and the economy is cyclical.

How Does This Affect The Housing Market?

Some media outlets spun this inflation into a threat of impending doom and gloom similarly to the 2008 housing market crash. Statistics are showing that it's nowhere close. In fact, according to Real Estate News article written by Executive Editor, Stacey Moncrieff she cites an interview with Lawrence Yun, chief economist for the National Association of REALTORS®;

[Even in areas where agents are seeing price declines, Yun said, 2022 is not a repeat of the 2008 housing crisis, when prices collapsed and foreclosures spiked. “Housing inventory is about a quarter of what it was in 2008,” he said. “Distressed property sales are almost nonexistent, about 2%, and nowhere near the 30% mark seen during the housing crash.”]

Generally speaking, with inflation comes rising mortgage rates. This reduces the amount of qualified home buyers and it also reduces the available inventory. Where is the positive spin? These statements don’t seem very positive, right? Wrong.

The Silver Lining

While rising mortgage rates, fewer qualified home buyers, and less inventory paints a not so pretty picture, in reality it’s a benefit for homeowners, buyers agents, and lenders.

Let’s take a moment to reflect and put ourselves in the shoes of a home buyer and the buyers agents. Your agent has found the perfect home for your family. Just enough bedrooms and bathrooms, a chef’s kitchen made for cooking and baking, a pristine backyard perfect for the kids and the dogs. Your agent and you decide to put in a bid and all chaos breaks loose. Now you are bidding against 30 other people, driving the asking price far above reasonability, and you feel forced to outbid the last bidder pushing you well past your financial comfort zone and racking up a gigantic mortgage payment. Let’s bring our story back to the here and now.

Same scene, perfect home, you found the right lender and your debt to income ratio is very balanced. You are feeling confident and ready to put in the offer, and in today's marketplace you only have two other bids you are up against - and - all within a reasonable price range. You’ve worked with your agent to prepare for just this situation leaving some wiggle room to easily outbid your competition without breaking the bank, literally. Your dream home is now yours without the fear, anxiety or personal risk.

As the market continues to stabilize, the quantity of homes for sale will begin to normalize. As a seller or a seller's agent, you have to make sure your property stands out. A smaller pool of homes for sale means the presentation must be more memorable. Hiring an interior design inspired staging company is not only a smart choice but an investment with a guaranteed return. Most homeowners will spend more on carrying costs, or even the first price reduction, than it costs to professionally stage the home to sell. We encourage you to always take some time and dig deeper. Whether it’s a home purchase, today’s news, or who you decide to hire to stage your home, it’s worth going below the surface to find the truth and some positive nuggets.